By David Choo, PromiseLand Independent

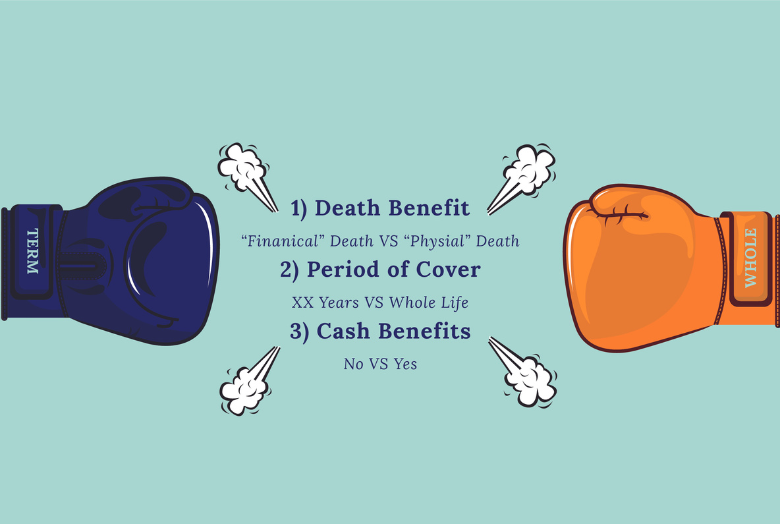

What is the fight about? And why the fight in the first place? And who is the referee? And who is the winner?

What is the fight about?

On one side, you have the whole life corner. This corner believes that the best way to benefit from life insurance is to make sure you really benefit from it. That is, you must have control over how long you stay in the game of life, since you do not know when your time will be up. And so the only policy which gives you control is whole life as you can decide to keep the policy alive as long as you are living. This means you will definitely have a claim. If you look at a life insurance policy, it is the death benefit which is a big figure. And this is, for the whole life insurance supporters, the chief reason for buying life insurance – the certainty of making a claim. But the catch is that, since death is certain, the insurers will have to be prepared and able to pay, so it means that the premium (cost) is higher.

What about the term insurance supporters? Their point is that physical death is really not the event that is feared in financial planning but the financial death or death of income for the working person. It can be said that, as long as we cover for one’s working life, or until the time when the dependents can take care of themselves, it is sufficient. They stress that the real purpose of term insurance is to ensure the continuation of income by being a replacement of salary for the term period necessary.

Term insurance is always for a stated period and can be as short as one year, either on a single life or for a group of people, for example, companies (group term life). But this means that every year you have to re-offer to be insured and if your health has deteriorated, you might be declined. A popular term policy is a 5-year convertible and renewable term which means that you can choose to convert it to a whole life or endowment plan or renew for another five years of term coverage. It can be renewed up to an agreed age but the premium increases for each age band.

Or you can choose the period of term cover to coincide with a loan repayment (like a mortgage decreasing term) or up to your planned retirement age. Whatever period you choose, at the end of the period, you have to step out. The insurance coverage is then ended. Thus it has been said when you buy a whole-life policy you are the owner. When you buy term insurance you are like a tenant and only have a temporary cover. Because of the shorter period and also because many people forget to pay the premium, the percentage of claims for term insurance is a very low single digit.

So far we have only spoken about the period of cover. There is another matter which needs to be addressed. It is the issue of whether you will receive any money if you do not have a claim for death during the period in question – this is called the cashback or cash benefit. In the good old days, it was called cash surrender value (CSV) which clearly says it is at the point of surrender or stopping payment.

Whole life policy has a cash benefit usually starting after three years. If your policy is “with profits” or participating in the performance of the insurer’s declared bonus, the cash benefit is higher than if the policy is “without benefits” or non-participating. Whether it is better to purchase a “with profit” or “without profit” policy is mainly dependent on whether you like to invest the difference in premium on your own.

Even a non-participating whole life has a cash value after the usual two or three years but the cash value is larger for participating plans.

It is this difference in premium between the whole life policy and the term policy for the same sum insured which can be set aside for investment, which creates the “fight” between the supporters of whole life and the supporters of the term. The issue is whether a person can invest the difference and do better than getting the “bonus” that the insurer declares yearly. The famous name for this “club” is “Buy term and invest the difference”.

Obviously, there are some who believe they can do better and some who prefer to let the insurer do the investing. They can compare the bonus rates paid by the insurers with their own investment over the years and consider the time is taken, anxiety, volatility, etc. A part of the insurance bonus is guaranteed while the other part is non-guaranteed which depends on what is declared annually.

Who should be the referee to decide the fight? Back then, when life insurance agents or advisers could only sell life insurance and no other investment products, they obviously were supporters of whole life products which also happened to pay larger commissions than for term insurance. Term insurance was mainly to protect mortgage loans and was taken by businesses and companies.

With the Financial Advisers Act 2002, licensed financial advisers were able to advise and distribute unit trusts and some other investments. Many financial adviser representatives began to move to “buying term and invest the difference”. During the boom years and low volatility up to 2008, the supporters grew in numbers. But when the Great Financial Crisis hit in 2008, many investors licked their financial wounds. Meanwhile, over the years, insurers have come up with “investment-linked” policies to offer a hybrid of insurance and investment. Universal life and variable universal life policies also came into the picture. Now making a choice of which plan best suits an investor has become a more complicated matter.

Who is the winner?

Clearly which product or combination of products best suit customers depend on the specific individual’s and family’s needs and the person’s risk tolerance and client knowledge assessment (CKA) and financial situation and goals.

Term insurance would be most suitable in some circumstances for certain people. Whole life and each variant would serve well in other circumstances for certain people.

This is where the financial adviser who is well-trained and most able to tap the whole spectrum of insurance companies and fund managers and their products would be most able to help the clients. Doing it yourself (DIY), whether for insurance or investment, is not as easy as it looks and warrants further examination.

This article was prepared by David Choo in his personal capacity. The opinions expressed in this article are the author’s own and do not reflect the view or position of PromiseLand Independent Pte Ltd.

If you are reading this, you are already taking or have taken steps to seek wisdom in making good choices in your finances. At PromiseLand, our ethos is “Trusted Advice, Trusted Advisor”. It means that we will walk the journey with you to make those choices that protect what you value most.